Welcome Edith and Nigel, MacIsaac & Company’s Newest “80% Associate Counsel”

Earlier this year we proudly launched our “80% Associate Counsel” career opportunity welcoming new talent to MacIsaac & Company under one of the more progressive arrangements in the legal industry.

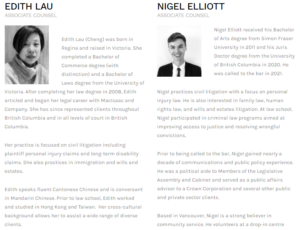

We are pleased to welcome our first two associate counsel joining our firm under this arrangement. Edith Lau, who will help expand our firm’s practice into immigration law and wills & estates and Nigel Elliott, who will be our first associate based out of Vancouver and will help grow our firm’s human rights and estate litigation practices.

You can read their full bio’s at our website and click here for more information about our 80% Associate Counsel Career!